VA loans are one of the few home loan types that usually don’t require a down payment. That means that a veteran or other qualifying borrower can fund the entire cost of the home with this loan, which is one of its most significant benefits.

The borrower is still responsible for covering the closing costs for a VA loan. Closing costs can be paid out-of-pocket, or you may receive lender or seller (or both) credits for them. Generally, sellers can pay up to 4% of the home price in the borrower’s closing costs. In most cases, the average VA closing costs are between 1% and 3% of the amount loaned for more expensive homes and 3% to 5% for less expensive homes.

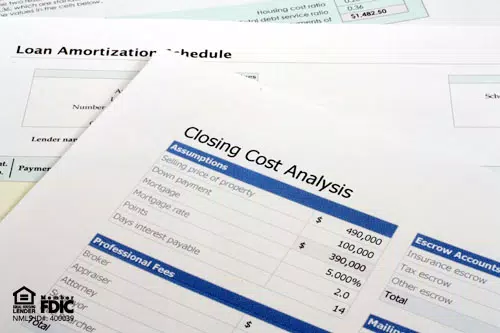

Closing Costs on VA Loans

VA loans have some closing costs in common with other loan programs. However, some are specific to just VA loans. Below is a list of the closing costs that a VA loan borrower should know more about:

VA funding fee. This fee helps Veterans Affairs afford to guarantee VA loans. All VA borrowers are required to pay this. The amount is a percentage added to the mortgage and varies by the borrower. First-time VA home buyers generally pay the lowest percentage, which can be as low as 1.25% of the loan. Other borrowers who may have used a VA loan in the past can pay as much as 3.30% of the total cost of the loan.

The size of the down payment and the borrower are the main factors in determining the amount charged for funding fees. VA refinance loans generally have lower funding fees than VA loans.

Lender fees. Lenders may charge a few different fees at the closing of your loan. These may include recording fees, title fees, credit report fees, flood certification, and appraisal costs. Fee amounts will be determined by several factors, such as the size of the mortgage, the home you are buying, and the institution you’ve chosen as your lender. These fees generally range from $20 to several hundred dollars.

Origination fee. Lenders charge the borrower. The VA limits a lender’s compensation on VA loans to 1% of the loan's value. If a lender chooses to charge this fee, the VA mandates that this fee compensate the lender in full. So, loan processing and underwriting can’t be charged on top of this origination fee.

Discount points. If you purchase discount points, you will pay for those points at closing. Purchasing discount points are not required for VA loans or other types of mortgages. They enable borrowers to lower the mortgage rate on their loans by purchasing discount points. The purpose of discount points is for the borrower to save money by reducing their monthly costs in the long run.

Homeowners insurance. You are required to purchase homeowners insurance for any home loan. Part of the payment must be paid at closing. You will want to pay close attention to what is included in your policy. Homeowners insurance isn’t comprehensive in every case, so you must ensure it includes adequate coverage. For instance, if you purchase a home in an area prone to flooding, you should consider adding flood insurance. Homeowner’s insurance will average you between $300 and $500.

Escrow Deposit. This fee is used for lenders to fund and pay property taxes and insurance on behalf of the borrower. Fees can vary with three determining factors:

- When the home closes, the time of year

- Taxes and insurance on the home purchased

- The property’s jurisdiction of when taxes are collected.

Once you’ve selected the property and set a closing date, you’ll need to get an estimate of your closing costs from your lender.

Other than the VA funding fee, you do not have the option to roll your closing costs into your VA loan. So ensure that you have saved enough reserves to cover these costs. You might be able to negotiate with your lender to purchase lender credits to offset your closing costs, which may ultimately increase your interest rate.

Ready to get a VA loan? Call our VA loan experts at 888-661-1982 to get started.