NASB is committed to protecting our customers' personal financial information. We use a combination of safeguards to protect our stored information and highly encourage you to take an active role in securing your own data.

5 Steps to Protecting Yourself Online

1. Register for a credit monitoring service.

For those people who were potentially impacted by the recent cybersecurity breach, Equifax is promoting their own credit monitoring service TrustedID free for one year. Other monitoring services, which may come with a fee, are available through companies such as Experian and LifeLock. To determine whether your personal information may have been impacted by this cybersecurity incident, visit www.EquifaxSecurity2017.com.

2. Check your credit reports once every four months.

This is free to do online at www.annualcreditreport.com, or you can visit the three credit bureaus directly and get a report from each.

3. Check your bank & credit card statements regularly for unauthorized activity.

Many cards, including debit cards issued by NASB come with 24/7 fraud monitoring services (like FraudWatch PLUS) to help detect suspicious activity. If you notice anything unusual on your statement, contact your bank or credit card company immediately.

4. Research other options:

- Fraud alert

A fraud alert requires potential creditors to contact you and obtain your permission before opening new lines of credit in your name. You are allowed by law to file a fraud alert – also called a “security alert” – with one of the credit bureaus (Equifax, Experian or TransUnion) every 90 days. Whichever one you file with is required by law to alert the other two bureaus. - Credit freeze

A credit freeze blocks all new credit applications under your identity until you “unfreeze.” Unfreezing the account can be done if you decide to apply for a loan or credit card, etc.

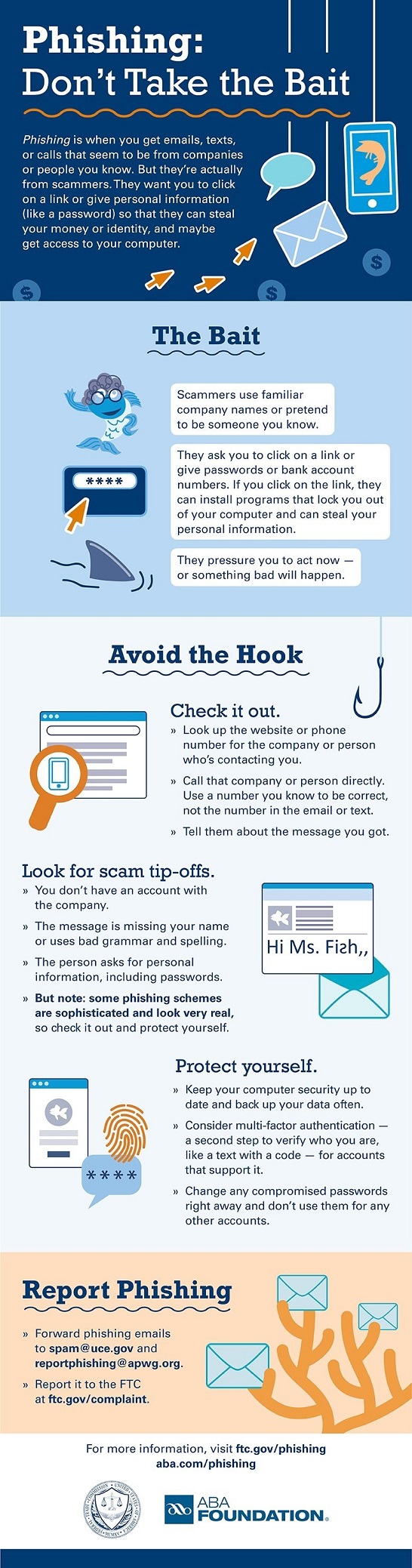

5. Be wary of scams.

Scams could include phishing emails with redirected website links, or callers that claim to be from Equifax, a credit card company, or a bank/credit union requesting information.

Want to find out more?

Visit the Identity Theft Resource Center at www.idtheftcenter.org .