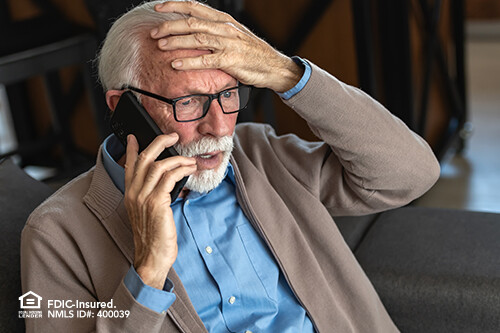

Phishing messages are designed to create a sense of urgency, panic, and impulse. They want you to act without thinking. But here’s the truth: as soon as you pause, breathe, and trust your instincts, the scam loses its power.

These messages often impersonate your bank or a trusted source, attempting to trick you into divulging personal information, such as your password, PIN, or Social Security number. Once they gain access, they can quickly steal your money from your account.

Don’t respond. Don’t click. Just delete. That simple act can protect your identity and your money.

Red Flags That Mean “Scam Alert”

Scammers depend on urgency and confusion. But their tactics follow a pattern. Here’s how to identify a phishing text before it catches you.

- Unusual phone numbers - Legitimate banks typically text from short codes—4 to 5 digits. If the number looks long or unfamiliar, it’s likely a scam.

- Hyperlinks in the message - Your bank will never ask you to log in via a link sent in a text. If you see one, don’t click.

- Odd grammar or spelling errors - Sloppy language is a major red flag. Professional institutions don’t send poorly written messages.

- Scare tactics and urgent language - “Act now!” “Your account will be locked!” These are designed to make you panic. Don’t fall for it.

- Requests to open a link or verify personal info - If a text asks for your login credentials, PIN, or SSN, it’s a scam—period.

Break the Spell Before It Breaks You

Phishing texts thrive on impulse. So next time you get a suspicious message:

Pause. Breathe. Snap out of it.

Then delete the message and move on with confidence.

For more resources, videos, and a quiz to test your scam-spotting skills, visit BanksNeverAskThat.com or nasb.com/security. Share with your loved ones—it could save someone from becoming a victim.