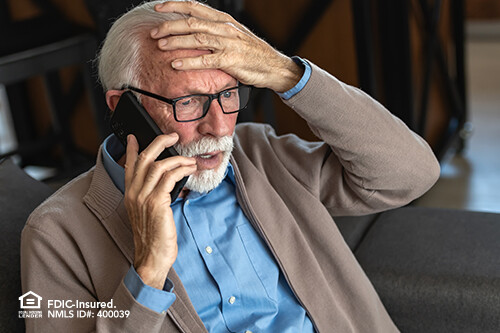

Scammers are becoming more creative and bolder. Every day, thousands of people are duped by fake emails, texts, and phone calls from scammers pretending to be trusted sources: your bank, a family member, government agencies, or law enforcement. As mobile and online banking expand, these schemes are happening more frequently and growing more sophisticated.

According to the Federal Trade Commission, U.S. consumers lost an astounding $12.5 billion to fraud in 2024, a 25% increase from the previous year. That’s not just a statistic—it’s a wake-up call.

These criminals know how to manipulate urgency and trust. They want you to panic, click, send, and share before you’ve had a chance to think. That’s why it’s so important to pause, assess, and protect yourself.

NASB Is Here to Help You Stay Scam-Smart

We’ve partnered with the American Bankers Association and financial institutions nationwide to help you recognize the signs of a scam—and stop it before it costs you. Our goal is clear: to empower every customer to become a smart scam-spotter.

If something feels off, don’t ignore that instinct. Take a moment. Breathe. Trust your gut.

Five Common Scam Signals to Watch For:

- Pressure to use payment apps or send money quickly - Stop and think.

- Unexpected contact urging secrecy and immediate action - Don’t rush.

- Texts with strange or unfamiliar links - Don’t click.

- Emails with attachments you didn’t ask for - Delete and report.

- Requests for sensitive info like your PIN, password, or Social Security number - Never share.

You may have seen these tactics before—but scammers count on catching you off guard. Stay alert, stay informed, and help others do the same.

For more resources, videos, and a quiz to test your scam-spotting skills, visit BanksNeverAskThat.com or nasb.com/security. Share with your loved ones—it could save someone from becoming a victim.